Labour Crisis Plaguing the Real Estate Sector Across the Spectrum from Construction to Property Management

March 28 , 2024

By Allwyn Dsouza, Senior Analyst, Research and Insights, REIC/ICI

By Allwyn Dsouza, Senior Analyst, Research and Insights, REIC/ICI

|

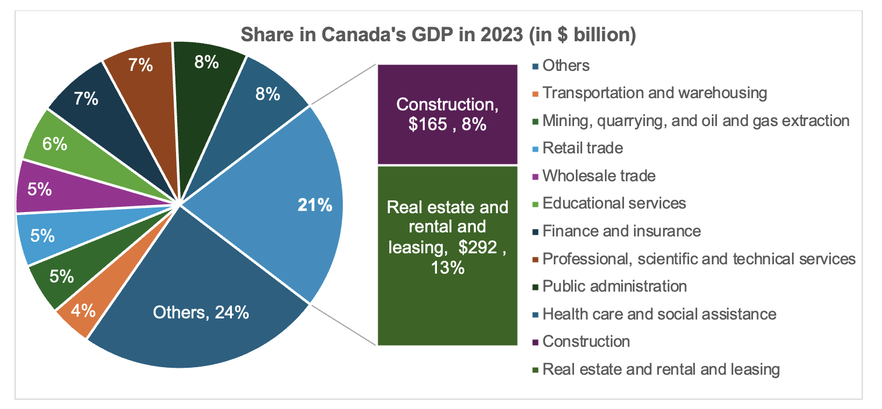

Construction and real estate together accounted for more than a fifth of Canada’s GDP in 2023. Although these industries are capital intensive, they are one of the largest employers in Canada. In 2023, ~1.6 million Canadians were employed in the construction industry, which amounts to approximately one out of every 13 working Canadians.

|

Figure 1.0

Source: Statistics Canada, Table 36-10-0434-03 Release date 2024-02-29

Others includes Utilities, Information and cultural industries, Administrative and support, waste management, and remediation services, Accommodation and food services, Agriculture, forestry, fishing, and hunting etc.

Others includes Utilities, Information and cultural industries, Administrative and support, waste management, and remediation services, Accommodation and food services, Agriculture, forestry, fishing, and hunting etc.

With growing population, the demand for housing and infrastructure is rising, leading to high demand for skilled labour. Following the COVID-19 pandemic, Canada’s construction sector has continued on a strong trajectory. Robust government investments nationwide have served to bolster construction activity. Additionally, there is sustained high demand for housing, and private-sector stakeholders remain actively engaged in construction endeavors.

Investment in the construction sector in Canada surged to unprecedented heights in 2022, driven mainly by the robust growth in the residential and industrial segments. While demand for new housing contracted in 2023 in response to rising interest rates, the long-term growth outlook remains strong. The non-residential construction sector is poised to see continued growth, fueled by increased public-sector investment in various projects such as major transit, utility, and road infrastructure developments spanning across provinces.

Investment in the construction sector in Canada surged to unprecedented heights in 2022, driven mainly by the robust growth in the residential and industrial segments. While demand for new housing contracted in 2023 in response to rising interest rates, the long-term growth outlook remains strong. The non-residential construction sector is poised to see continued growth, fueled by increased public-sector investment in various projects such as major transit, utility, and road infrastructure developments spanning across provinces.

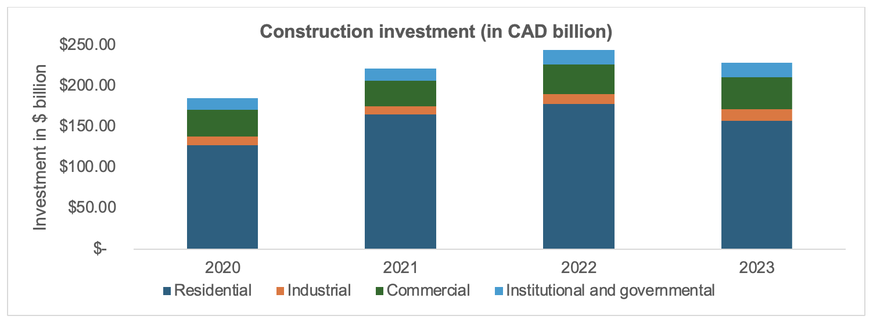

Figure 2.0

Source: Statistics Canada, Table 34-10-0175-01 Release date 2023-12-18

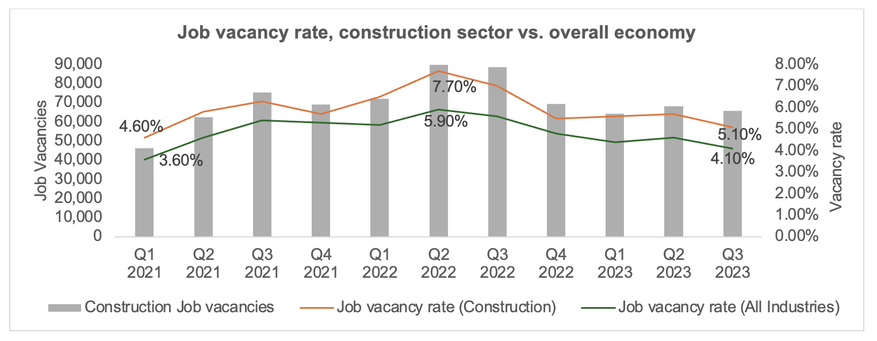

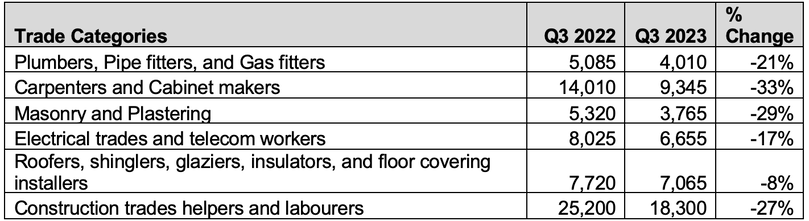

This has created significant demand for labour and the sector is experiencing an acute shortage of skilled labour. Though the vacancies in the construction industry have climbed down significantly from the highs recorded in Q2 2022, there are currently close to 70,000 vacant positions, about 5.3% of the total workforce. This surpasses the 4% job vacancy rate observed for the Canadian economy overall. Despite a sharp reduction in Q3 2023 vs. Q3 2022, vacancies in construction trades including roofers and shinglers, glaziers, insulators, floor covering installers, carpenters, electricians, and construction trade helpers were the highest.

Figure 3.0

Source: Statistics Canada, Table 14-10-0326-01, Release date 2023-12-18

Table 01: Vacancies across trade categories

Source: statcan.gc.ca

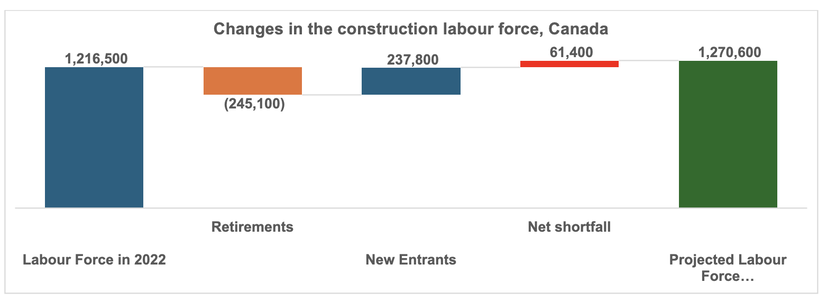

The ageing workforce further exacerbates this labour shortage. With around 20% of the construction labour force, primarily from the baby boomer generation, expected to retire in the next 10 years, not enough new workers are coming into the trades, leading to many unfilled positions. A report by Buildforce Canada[1] forecasts a net shortfall in the construction labour force of 61,400, after factoring addition of new entrants into the trade.

Figure 4.0

Unfortunately, the construction industry is currently on the losing side of this battle, with the number of newcomers entering the sector having been in decline for several decades, particularly in the skilled trades. Immigrants account for only about 18 per cent of workers in the construction industry, far below the national average of 23 per cent for the Canadian labour market[2] . This can be partly attributed to Federal immigration policies that tend to give preference to those individuals with higher levels of education. According to CIBC estimates, only 2 per cent of all immigrants go into the construction sector and this too is on a decline. Even among temporary foreign workers only 11 per cent choose to enter the construction sector[3] .

The federal government’s immigration targets for 2024 are unlikely to address the construction labour shortage either. Immigration, Refugees, and Citizenship Canada (IRCC) is targeting 30% of the 450,000 new permanent residents in 2024 to have a background in tech and only 3%-5% in construction. This equates to about one-fourth of current job vacancies. Without sufficient labour, meeting Canada’s ambitious housing supply needs will be impossible.[4]

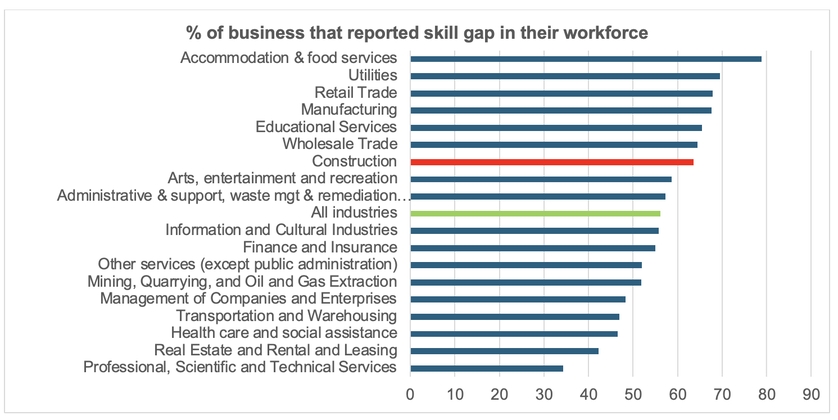

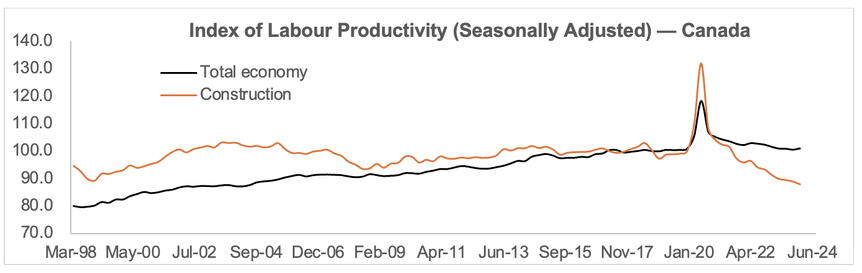

Even among those joining the industry, there is a severe skill gap with 63.6% of the businesses reporting a skill gap in their workforce. This has significantly impacted the labour productivity in the industry, with labour productivity in the construction sector lagging other industries and the gap has been widening in recent years. This is further compounding the labour shortage.

The federal government’s immigration targets for 2024 are unlikely to address the construction labour shortage either. Immigration, Refugees, and Citizenship Canada (IRCC) is targeting 30% of the 450,000 new permanent residents in 2024 to have a background in tech and only 3%-5% in construction. This equates to about one-fourth of current job vacancies. Without sufficient labour, meeting Canada’s ambitious housing supply needs will be impossible.[4]

Even among those joining the industry, there is a severe skill gap with 63.6% of the businesses reporting a skill gap in their workforce. This has significantly impacted the labour productivity in the industry, with labour productivity in the construction sector lagging other industries and the gap has been widening in recent years. This is further compounding the labour shortage.

Figure 5.0

Source: SEWS (2022)

Figure 6.0

Source: Statistics Canada, Table 36-10-0207-01 Release date 2024-03-06

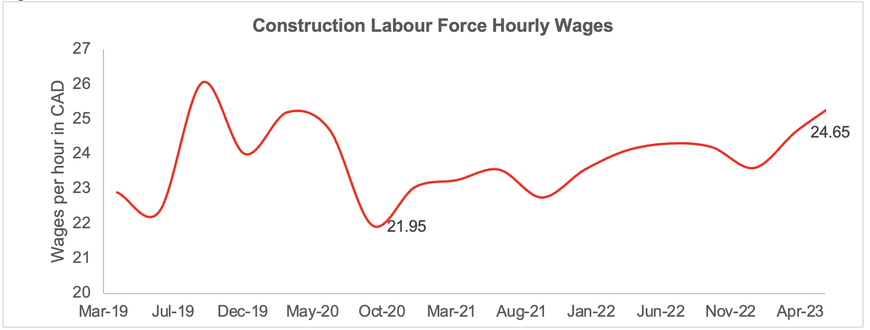

An elevated job vacancy rate will continue to keep wage growth higher than normal, thus contributing to higher-than-average construction cost inflation despite material cost inflation cooling down.

Figure 7.0

Source: Statistics Canada, Table 14-10-0326-01, Release date 2023-12-18

In addition to zoning, fees, permits, and material costs, labour shortage in the construction industry has become a critical factor hindering efforts to bridge the housing gap. This shortage, coupled with the rising cost of wages, underscores the multitude of challenges faced by the construction industry in meeting the housing demand.

Another fallout of the shrinking labour force is delay in project completions, with project timelines stretching to over 25 months in 2022[5] .

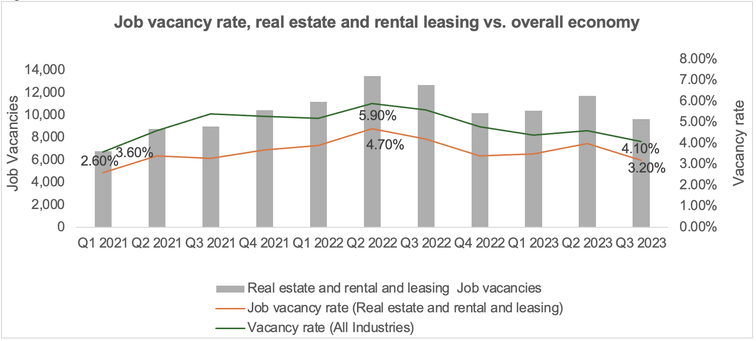

One would assume the problem ends once the construction is complete. However, the shortage of skilled workforce in the real estate sector is continuing even beyond completion when it comes to managing properties. Shortfall of property managers has reached crisis levels.

Even among the talent pool that is available there is a significant skill gap. According to Canadian Survey on Business Conditions results (Figure 5.0), 42.3% of businesses reported a skill gap in their workforce. Like construction, the property management labour force is facing a looming retirement crisis with more than 50% of the current property management professionals from the baby boomer generation.

According to statistics Canada, 115,726 apartment units (both rental and condominiums) were completed in 2022 and another 150,988 units were recorded under housing starts in 2023. This will further aggravate the shortfall and put upward pressure on wages which would translate into higher management fees and a higher rent burden.

Another fallout of the shrinking labour force is delay in project completions, with project timelines stretching to over 25 months in 2022[5] .

One would assume the problem ends once the construction is complete. However, the shortage of skilled workforce in the real estate sector is continuing even beyond completion when it comes to managing properties. Shortfall of property managers has reached crisis levels.

Even among the talent pool that is available there is a significant skill gap. According to Canadian Survey on Business Conditions results (Figure 5.0), 42.3% of businesses reported a skill gap in their workforce. Like construction, the property management labour force is facing a looming retirement crisis with more than 50% of the current property management professionals from the baby boomer generation.

According to statistics Canada, 115,726 apartment units (both rental and condominiums) were completed in 2022 and another 150,988 units were recorded under housing starts in 2023. This will further aggravate the shortfall and put upward pressure on wages which would translate into higher management fees and a higher rent burden.

Figure 8.0

Source: Statistics Canada, Table 14-10-0326-01, Release date 2023-12-18

Industry practitioners argue that the issue stems not from a lack of available individuals but rather from a myriad of factors, including policies, challenges related to worker burnout, and the absence of a clearly defined career trajectory.

There is a notable gap between the available talent pool and the policies aimed at making them employable. While immigration pathways attract individuals with the necessary skills and qualifications, the current regulatory landscape often hinders a smooth integration into the Canadian workforce due to lengthy and costly local qualification processes. Consequently, many skilled individuals find themselves working in fields unrelated to their expertise, despite being qualified for roles in construction or property management.

Nathan Paul, a CPM® (Certified Property Manager®) and a Fellow of the Royal Institution of Chartered Surveyors brings extensive experience from diverse global markets such as the UK, Asia, and the Middle East, asserts that, “addressing the talent shortage requires exploring potential solutions inspired by successful programs implemented in other jurisdictions.”

“One solution lies in programs like the realtor license program and the Certified Leasing Officer (CLO) program offered by the Real Estate Institute of Canada (REIC), which are characterized by shorter durations and affordability. Additionally, introducing specialized, shorter-term alignment work programs explicitly crafted for experienced professionals and tradesmen to address project-specific demands at affordable costs within the construction sector could help alleviate the workforce shortage. REIC possesses the capacity to offer similar streamlined license programs tailored to property management, facilities management, and construction courses, ensuring better alignment between talent and the urgent industry needs.”

The growing complexity of property management, coupled with the intricacies of tenancy laws and evolving market dynamics, has placed an unprecedented strain on the industry.

Property managers are responsible for overseeing daily communications and operations, including enforcing community by-laws, and maintaining property upkeep. They also coordinate security measures and oversee necessary renovations and upgrades, all of which contribute to preserving property values. Additionally, they play a crucial role in managing financial matters, ensuring proper budgeting and the maintenance of reserve funds.

In the absence of skilled property managers, properties suffer. This can subsequently lead to poor tenant relations, inadequate maintenance, and poor delivery of the strategic capital plan. Additionally, poor financial management by under skilled managers raises the risk of leaving the property vulnerable to cash flow issues and capital shortfalls. Compliance and regulatory problems may also arise, exposing ownership to significant risks.

This challenge is a reality for professionals like Robin Hardman CPM®, RPA, General Manager at McCOR, who grapple with it regularly. Addressing the issue, she remarked, "Finding talent remains a challenge across all levels. Often, we focus on strong administrators who perform well and train them for property manager roles. Small margins often mean the management portfolios have to be large which can lead to high levels of burnout and a subsequent exodus of professionals from the field, further exacerbating the shortage of skilled and experienced resources. This is especially true on the condo/strata side. The absence of a defined career path and formal recognition as a profession further impedes the entry of new talent."

What are the solutions?

Both the federal government and the provinces are directing their efforts towards enhancing the immigration program and expanding quotas for temporary work programs. These initiatives aim to specifically attract individuals with sought-after trade skills. Additionally, strategies such as diversifying the talent pool, bridging skill gaps, and leveraging technology to boost productivity are being explored.

Technology is poised to address a significant portion of the challenges facing property management by streamlining processes, automating tasks, and enhancing overall efficiency. While the real estate sector has traditionally been slow to embrace technological advancements, a wave of proptech firms is emerging with innovative solutions.

Al-Karim Khimji, CEO & Co-Founder of Propra, underscores the pivotal role of technology in mitigating labour shortages and optimizing operational efficiency within property management. He asserts, “Technology offers a practical solution to labour shortages in property management by significantly boosting efficiency. Using automation and AI to tackle common pain points like communication, coordination, and customer query handling can free up property managers from administrative tasks and allow them to focus on value-added activities. Many of our customers have experienced remarkable results, doubling their managed units without increasing their team size, and thus unlocking substantial efficiency improvements and revenue. This underscores the belief that with effective deployment, technology can deliver a compelling return on investment.”

Increasing the participation of women and Indigenous people in the trade can help diversify the talent base. The skill gap can be reduced by reversing the negative trend seen in apprenticeships by using tax incentives and funding support and mandating/sponsoring training and certification programs.

While these are good measures, they can only move the needle as much. There lies a bigger problem at the heart of the issue, which is about making the vocation more appealing to the current generation. The construction and manufacturing industries continue to be perceived by many as low-tech, dangerous, and dirty. There is an urgent need to change the narrative.

In today's real estate labour market, even white-collar roles like property management often lack the recognition and aspirational status afforded to fields such as Law, Taxation, and Auditing. While these professions typically require formal education and certification to validate credentials, the same level of standardization is often absent in property management. As Neil Fawcett, CPM®, ARM®, an educator, and seasoned property manager puts it, 'Property management has historically been plagued by outdated perceptions. However, it has evolved significantly beyond a mere side occupation for the unskilled. The modern demands of the profession necessitate stringent standards, formal education programs, certifications, and structured career paths. Institutions like REIC play a crucial role in spearheading this necessary transformation.”

There is a notable gap between the available talent pool and the policies aimed at making them employable. While immigration pathways attract individuals with the necessary skills and qualifications, the current regulatory landscape often hinders a smooth integration into the Canadian workforce due to lengthy and costly local qualification processes. Consequently, many skilled individuals find themselves working in fields unrelated to their expertise, despite being qualified for roles in construction or property management.

Nathan Paul, a CPM® (Certified Property Manager®) and a Fellow of the Royal Institution of Chartered Surveyors brings extensive experience from diverse global markets such as the UK, Asia, and the Middle East, asserts that, “addressing the talent shortage requires exploring potential solutions inspired by successful programs implemented in other jurisdictions.”

“One solution lies in programs like the realtor license program and the Certified Leasing Officer (CLO) program offered by the Real Estate Institute of Canada (REIC), which are characterized by shorter durations and affordability. Additionally, introducing specialized, shorter-term alignment work programs explicitly crafted for experienced professionals and tradesmen to address project-specific demands at affordable costs within the construction sector could help alleviate the workforce shortage. REIC possesses the capacity to offer similar streamlined license programs tailored to property management, facilities management, and construction courses, ensuring better alignment between talent and the urgent industry needs.”

The growing complexity of property management, coupled with the intricacies of tenancy laws and evolving market dynamics, has placed an unprecedented strain on the industry.

Property managers are responsible for overseeing daily communications and operations, including enforcing community by-laws, and maintaining property upkeep. They also coordinate security measures and oversee necessary renovations and upgrades, all of which contribute to preserving property values. Additionally, they play a crucial role in managing financial matters, ensuring proper budgeting and the maintenance of reserve funds.

In the absence of skilled property managers, properties suffer. This can subsequently lead to poor tenant relations, inadequate maintenance, and poor delivery of the strategic capital plan. Additionally, poor financial management by under skilled managers raises the risk of leaving the property vulnerable to cash flow issues and capital shortfalls. Compliance and regulatory problems may also arise, exposing ownership to significant risks.

This challenge is a reality for professionals like Robin Hardman CPM®, RPA, General Manager at McCOR, who grapple with it regularly. Addressing the issue, she remarked, "Finding talent remains a challenge across all levels. Often, we focus on strong administrators who perform well and train them for property manager roles. Small margins often mean the management portfolios have to be large which can lead to high levels of burnout and a subsequent exodus of professionals from the field, further exacerbating the shortage of skilled and experienced resources. This is especially true on the condo/strata side. The absence of a defined career path and formal recognition as a profession further impedes the entry of new talent."

What are the solutions?

Both the federal government and the provinces are directing their efforts towards enhancing the immigration program and expanding quotas for temporary work programs. These initiatives aim to specifically attract individuals with sought-after trade skills. Additionally, strategies such as diversifying the talent pool, bridging skill gaps, and leveraging technology to boost productivity are being explored.

Technology is poised to address a significant portion of the challenges facing property management by streamlining processes, automating tasks, and enhancing overall efficiency. While the real estate sector has traditionally been slow to embrace technological advancements, a wave of proptech firms is emerging with innovative solutions.

Al-Karim Khimji, CEO & Co-Founder of Propra, underscores the pivotal role of technology in mitigating labour shortages and optimizing operational efficiency within property management. He asserts, “Technology offers a practical solution to labour shortages in property management by significantly boosting efficiency. Using automation and AI to tackle common pain points like communication, coordination, and customer query handling can free up property managers from administrative tasks and allow them to focus on value-added activities. Many of our customers have experienced remarkable results, doubling their managed units without increasing their team size, and thus unlocking substantial efficiency improvements and revenue. This underscores the belief that with effective deployment, technology can deliver a compelling return on investment.”

Increasing the participation of women and Indigenous people in the trade can help diversify the talent base. The skill gap can be reduced by reversing the negative trend seen in apprenticeships by using tax incentives and funding support and mandating/sponsoring training and certification programs.

While these are good measures, they can only move the needle as much. There lies a bigger problem at the heart of the issue, which is about making the vocation more appealing to the current generation. The construction and manufacturing industries continue to be perceived by many as low-tech, dangerous, and dirty. There is an urgent need to change the narrative.

In today's real estate labour market, even white-collar roles like property management often lack the recognition and aspirational status afforded to fields such as Law, Taxation, and Auditing. While these professions typically require formal education and certification to validate credentials, the same level of standardization is often absent in property management. As Neil Fawcett, CPM®, ARM®, an educator, and seasoned property manager puts it, 'Property management has historically been plagued by outdated perceptions. However, it has evolved significantly beyond a mere side occupation for the unskilled. The modern demands of the profession necessitate stringent standards, formal education programs, certifications, and structured career paths. Institutions like REIC play a crucial role in spearheading this necessary transformation.”

[1] Construction And Maintenance Looking Forward: An Assessment of Construction Labour Markets From 2023 To 2032

[2] Immigration.ca

[3] The Global Mail

[4] U.S. and Canada Construction Trends 2024 Forecast, JLL

[5] Storeys.com

[2] Immigration.ca

[3] The Global Mail

[4] U.S. and Canada Construction Trends 2024 Forecast, JLL

[5] Storeys.com

Allwyn Dsouza is REIC’s Senior Analyst, Market Research and Insights. He can be reached at [email protected]. Media enquiries can be directed to [email protected]