Rewarding Timely Rent Payments - A Small but Important Step to Address the Affordability Issue

April 19, 2024

By Allwyn Dsouza, Senior Analyst, Research and Insights, REIC/ICI

By Allwyn Dsouza, Senior Analyst, Research and Insights, REIC/ICI

|

Last month, the Federal Government announced its intention to introduce a renters' bill of rights in the upcoming 2024 Budget, mandating the inclusion of rent payment history for credit appraisal and mortgage underwriting. Prime Minister Justin Trudeau highlighted the fundamental unfairness of paying $2,000 monthly for rent compared to building equity and credit through mortgage payments. At REIC, we see this as a critical initiative in tackling housing affordability by leveraging alternative data sources for mortgage underwriting and credit assessment and fostering digitization of payments and financial inclusion.

|

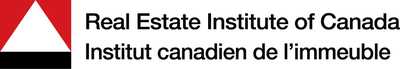

Promoting increased digitization of payments

Advancements in technology, particularly in fintech, make the proposed change more viable compared to a few years earlier. It has the potential to accelerate the digitization of payments, as cash has the highest prevalence in rent payments compared to other bills. According to a report by payments.ca[1] , although cash payments are declining, they still account for nearly 10% of all transactions, underscoring the importance this measure will play in transitioning to digital payment methods.

Advancements in technology, particularly in fintech, make the proposed change more viable compared to a few years earlier. It has the potential to accelerate the digitization of payments, as cash has the highest prevalence in rent payments compared to other bills. According to a report by payments.ca[1] , although cash payments are declining, they still account for nearly 10% of all transactions, underscoring the importance this measure will play in transitioning to digital payment methods.

Figure 1.0

Source: payments.ca

A step toward financial inclusion and wealth creation

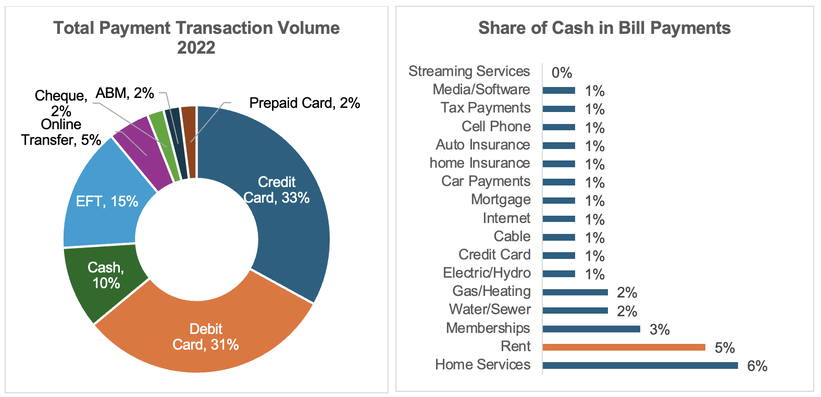

Why is homeownership essential for financial inclusion? Real estate holds a distinct role in the balance sheets of households in advanced economies. It stands out historically as the primary appreciating non-financial asset and is unique in its continuous appreciation while also being consumed through the owner's equivalent rent. This combination provides a crucial safety net, allowing for the acquisition and liquidation of other assets that can be more easily passed on as financial support. In contrast, renting households lack this equivalent mechanism. Further, wealth built through home equity is more sustainable as it is preserved over longer periods of time and compounds uninterrupted in contrast to other forms of wealth attained through high income, equities, or windfall gains like lottery.

Wealth inequality in Canada is not just a story of rich versus poor; it is one of homeowners versus non-homeowners. Canada’s residential housing accounts for over one-fifth of the national wealth. For the 10 million Canadian households who own their home, their home is also an investment and often their largest monetary asset[2].

Why is homeownership essential for financial inclusion? Real estate holds a distinct role in the balance sheets of households in advanced economies. It stands out historically as the primary appreciating non-financial asset and is unique in its continuous appreciation while also being consumed through the owner's equivalent rent. This combination provides a crucial safety net, allowing for the acquisition and liquidation of other assets that can be more easily passed on as financial support. In contrast, renting households lack this equivalent mechanism. Further, wealth built through home equity is more sustainable as it is preserved over longer periods of time and compounds uninterrupted in contrast to other forms of wealth attained through high income, equities, or windfall gains like lottery.

Wealth inequality in Canada is not just a story of rich versus poor; it is one of homeowners versus non-homeowners. Canada’s residential housing accounts for over one-fifth of the national wealth. For the 10 million Canadian households who own their home, their home is also an investment and often their largest monetary asset[2].

Figure 2.0

Source: Statistics Canada

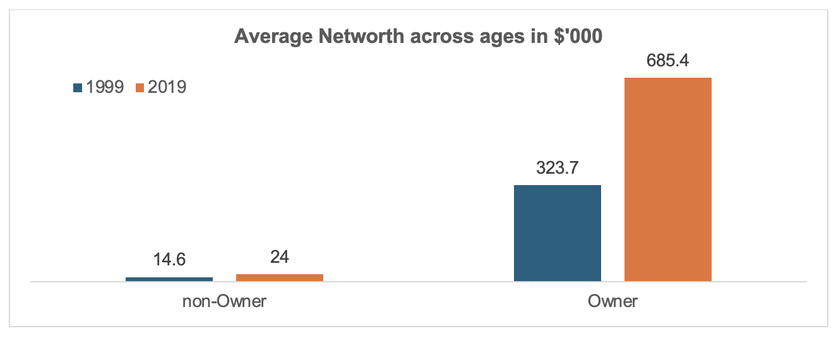

Figure 3.0

Owning a home contributes significantly to building generational wealth, with home equity representing a substantial portion of overall net worth. For homeowners born between 1955 and 1964, the average net worth now exceeds $1.4 million, which is 6.3 times higher than that of non-homeowners born during the same period.[3]

According to a recent report by RBC, homeowners have experienced a growth in net worth from nine to 13 times their household disposable income since 2010. In comparison, renters saw their net wealth increase from three to 3.5 times their income during the same period.

The report highlighted that the accelerated growth in wealth among homeowners reflects a broader trend where homeownership has contributed to almost half of the wealth accumulation over the past three decades.[4]

According to Statistics Canada, in 2021, 5 million households rented the home they lived in—up from 4.1 million a decade earlier[5] . Growth in renter households (21.5%) was more than double that of homeowners (8.4%) from 2011 to 2021[6] .

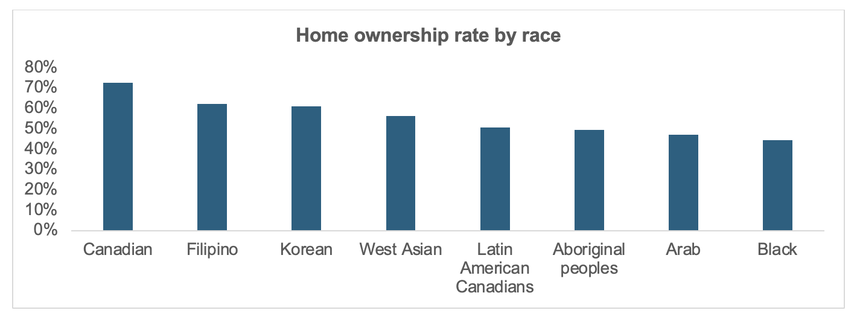

According to a CMHC report published in 2021[7] , home ownership rate among Canadians was 72.61% in 2016 which fell by 2.74 percentage points compared to 2011. However, homeownership varied significantly by race. Blacks, Arabs, Aboriginal people, and Latin American Canadians had the lowest homeownership rates and the gap widened further in 2016, compared to 2011. The gap also remained when controlled for demographic, location, and income. South Asians, Whites, and Chinese were the only groups that were above the national average. Hence, it is imperative to facilitate homeownership among renters and helping them build a healthy credit score is a step in that direction.

The report highlighted that the accelerated growth in wealth among homeowners reflects a broader trend where homeownership has contributed to almost half of the wealth accumulation over the past three decades.[4]

According to Statistics Canada, in 2021, 5 million households rented the home they lived in—up from 4.1 million a decade earlier[5] . Growth in renter households (21.5%) was more than double that of homeowners (8.4%) from 2011 to 2021[6] .

According to a CMHC report published in 2021[7] , home ownership rate among Canadians was 72.61% in 2016 which fell by 2.74 percentage points compared to 2011. However, homeownership varied significantly by race. Blacks, Arabs, Aboriginal people, and Latin American Canadians had the lowest homeownership rates and the gap widened further in 2016, compared to 2011. The gap also remained when controlled for demographic, location, and income. South Asians, Whites, and Chinese were the only groups that were above the national average. Hence, it is imperative to facilitate homeownership among renters and helping them build a healthy credit score is a step in that direction.

Figure 4.0

Source: CMHC

How will including rent payments in credit assessment and mortgage underwriting help?

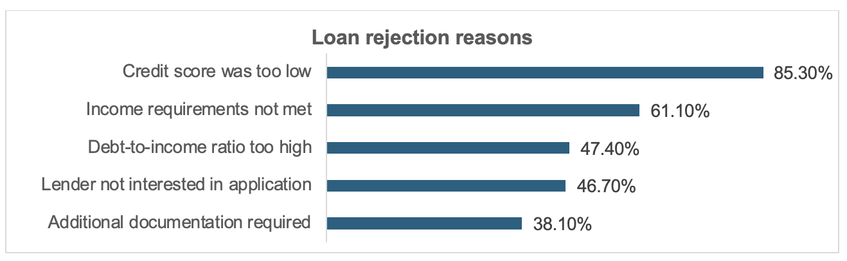

Credit score plays a crucial role in assessing eligibility for any kind of credit. A recent survey conducted by Loans Canada on the borrowing experience of Canadians for online personal loans, sited low credit score as the top reason for loan rejection. Moreover, 76% of the respondants surveyed lived in rented accommodation. While a similar study is not available for mortgage underwriting, it would most likely have similar results if conducted.

Credit score plays a crucial role in assessing eligibility for any kind of credit. A recent survey conducted by Loans Canada on the borrowing experience of Canadians for online personal loans, sited low credit score as the top reason for loan rejection. Moreover, 76% of the respondants surveyed lived in rented accommodation. While a similar study is not available for mortgage underwriting, it would most likely have similar results if conducted.

Figure 5.0

Source: LoansCanada.ca

According to a report by Equifax more than three million adults in Canada don't have a credit score, while a further seven million have only limited data that could hinder their ability to access credit products.[8] According to another study conducted by Transunion in the same year, the number of credit unserved and underserved population stood at 9 million.[9]

As such, including rent payments into a credit score would help many Canadians develop a better credit score and payment history. According to findings of a study conducted by Equifax Canada in collaboration with FrontLobby (a rent reporting platform) that looked at a subset of consumers who use the FrontLobby platform, 48 per cent of the renters who reported through their platform were currently scoreable based solely on the rental data reported into Equifax.[2]

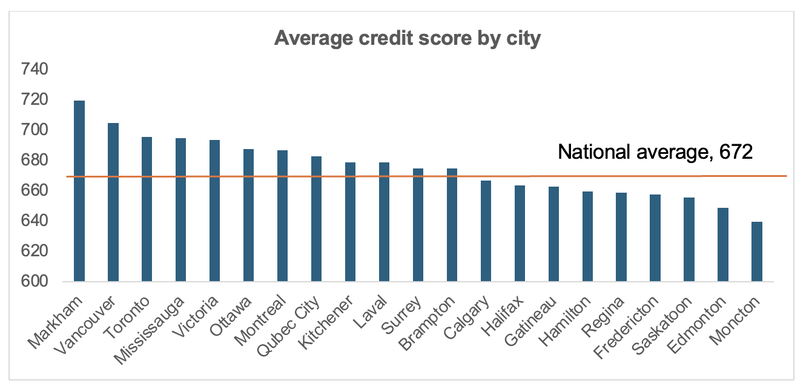

A good credit score has implications for a borrower’s mortgage rate, insurance premium, tenure, and loan amount. A credit score of 680 or above is required to qualify for the best mortgage rates in Canada in 2024.[10] Some mortgage providers allow you to qualify with credit scores between 600 and 680, but these providers may charge higher interest rates. In contrast, according to 2022 data from over 2 million Borrowell members, the average Canadian credit score is 672.[11]

As such, including rent payments into a credit score would help many Canadians develop a better credit score and payment history. According to findings of a study conducted by Equifax Canada in collaboration with FrontLobby (a rent reporting platform) that looked at a subset of consumers who use the FrontLobby platform, 48 per cent of the renters who reported through their platform were currently scoreable based solely on the rental data reported into Equifax.[2]

A good credit score has implications for a borrower’s mortgage rate, insurance premium, tenure, and loan amount. A credit score of 680 or above is required to qualify for the best mortgage rates in Canada in 2024.[10] Some mortgage providers allow you to qualify with credit scores between 600 and 680, but these providers may charge higher interest rates. In contrast, according to 2022 data from over 2 million Borrowell members, the average Canadian credit score is 672.[11]

Figure 6.0

Source: Borrowell

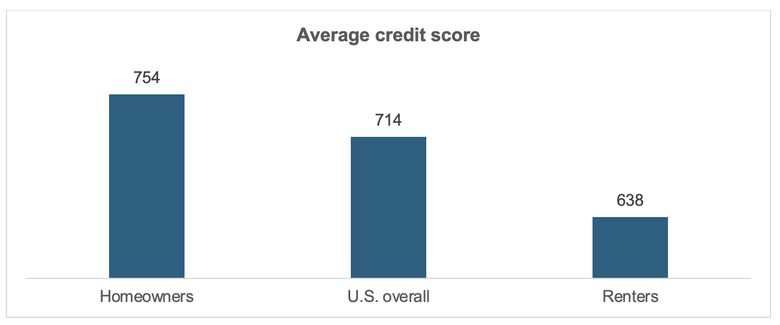

Studies conducted in the US, which has a similar homeownership rate and credit market characteristics as Canada, show a marked difference in the credit scores between homeowners and renters.

Source: St. Louis Federal Reserve

Rent is the single largest recurring monthly component of most people’s expenses. Since payment history accounts for 35% of the credit score, including rent in payment history can significantly help improve credit scores for renters who make timely rent payments.

In September 2022, Fannie Mae introduced the "Positive Rent Payment" pilot to enable renters to build and establish their credit scores. As of September 2023, over 100 property owners, 2,170 properties, and 435,000 units have enrolled in the pilot. So far, it has seen 240,000 participants reporting their rent payments and 23,000 credit scores being established, with nearly 58% of the participants increasing their credit score by an average of 40 points.[12] Seeing positive results from the pilot, Fannie Mae is extending the said pilot program through December 2024.

This measure can also prove to be beneficial for both mortgage underwriters and property managers. Studies have found that rent payment history can be a better predictor of creditworthiness, as it closely mimics mortgage payments. A monthly mortgage payment is a similar expense to a monthly rental payment, and until the recent steep rise in mortgage rates, in many parts of the country, the median mortgage payment was lower than the median rent payment.[13] Property owners will also benefit from timely rent payments as improved and a more stable credit score will incentivize renters with greater financial opportunities.

Potential hurdles in implementations

Rent reporting can place more power in the hands of landlords and property owners and further exacerbate the very problem the policy is seeking to address. Many tenants use late rent payment as a redressal mechanism for ensuring owners fulfil their fiduciary responsibility and maintain agreed service quality. Many fear that landlords can use the rent reporting mechanism to intimidate renters into making timely payment without providing commensurate services and quality accommodation. Possible mitigants include making the reporting voluntary and alternatively only reporting positive payments, as done in the case of Fannie Mae, given that landlords already have the option to report rent delinquencies.

A large part of the rent reporting burden will fall on property managers and landlords both in terms of costs and operational resources. Given the thin margins, most property managers have been shying away from the additional burden despite having many rent reporting agencies that provide this service to property managers, as it has been difficult to quantify the benefits. The government could subsidize the reporting costs as it will contribute toward achieving its social agenda of financial inclusion.

Creating awareness and messaging to promote the adoption of rent reporting is going to be a challenge. Currently, private players like Landlord Credit Bureau, Front Lobby, and others have partnered with Equifax and Transunion to report rent payment data, but there is limited awareness and adoption among renters. The government could build rent reporting requirements into some of its funding programs. Alternatively, it could leverage some of its counselling infrastructure and include the positive impacts of rent reporting as part of its broader financial education programs.

Implementing the reporting framework and investing in developing the necessary technology infrastructure may pose challenges. The government could explore using existing commercial rent reporting platforms or establishing an intermediary data aggregator platform to access bank account records with consumers' consent. The latter approach could be particularly beneficial for tenants who rent from small-scale landlords. It can be challenging to incentivize these landlords, who own only a few units, to report to credit bureaus. This is especially important since the tenants of such landlords often come from low-income and marginalized communities. Moreover, revising underwriting and credit assessment models will be necessary to maintain the quality of credit for loans. Further research is essential to grasp the effects of integrating rent reporting on credit scores, risk pricing in underwriting, and loan delinquency.

In September 2022, Fannie Mae introduced the "Positive Rent Payment" pilot to enable renters to build and establish their credit scores. As of September 2023, over 100 property owners, 2,170 properties, and 435,000 units have enrolled in the pilot. So far, it has seen 240,000 participants reporting their rent payments and 23,000 credit scores being established, with nearly 58% of the participants increasing their credit score by an average of 40 points.[12] Seeing positive results from the pilot, Fannie Mae is extending the said pilot program through December 2024.

This measure can also prove to be beneficial for both mortgage underwriters and property managers. Studies have found that rent payment history can be a better predictor of creditworthiness, as it closely mimics mortgage payments. A monthly mortgage payment is a similar expense to a monthly rental payment, and until the recent steep rise in mortgage rates, in many parts of the country, the median mortgage payment was lower than the median rent payment.[13] Property owners will also benefit from timely rent payments as improved and a more stable credit score will incentivize renters with greater financial opportunities.

Potential hurdles in implementations

Rent reporting can place more power in the hands of landlords and property owners and further exacerbate the very problem the policy is seeking to address. Many tenants use late rent payment as a redressal mechanism for ensuring owners fulfil their fiduciary responsibility and maintain agreed service quality. Many fear that landlords can use the rent reporting mechanism to intimidate renters into making timely payment without providing commensurate services and quality accommodation. Possible mitigants include making the reporting voluntary and alternatively only reporting positive payments, as done in the case of Fannie Mae, given that landlords already have the option to report rent delinquencies.

A large part of the rent reporting burden will fall on property managers and landlords both in terms of costs and operational resources. Given the thin margins, most property managers have been shying away from the additional burden despite having many rent reporting agencies that provide this service to property managers, as it has been difficult to quantify the benefits. The government could subsidize the reporting costs as it will contribute toward achieving its social agenda of financial inclusion.

Creating awareness and messaging to promote the adoption of rent reporting is going to be a challenge. Currently, private players like Landlord Credit Bureau, Front Lobby, and others have partnered with Equifax and Transunion to report rent payment data, but there is limited awareness and adoption among renters. The government could build rent reporting requirements into some of its funding programs. Alternatively, it could leverage some of its counselling infrastructure and include the positive impacts of rent reporting as part of its broader financial education programs.

Implementing the reporting framework and investing in developing the necessary technology infrastructure may pose challenges. The government could explore using existing commercial rent reporting platforms or establishing an intermediary data aggregator platform to access bank account records with consumers' consent. The latter approach could be particularly beneficial for tenants who rent from small-scale landlords. It can be challenging to incentivize these landlords, who own only a few units, to report to credit bureaus. This is especially important since the tenants of such landlords often come from low-income and marginalized communities. Moreover, revising underwriting and credit assessment models will be necessary to maintain the quality of credit for loans. Further research is essential to grasp the effects of integrating rent reporting on credit scores, risk pricing in underwriting, and loan delinquency.

[1] The Future of Digital Payments is here - Canadian Payment Methods and Trends Report 2023

[2] https://www.statcan.gc.ca/o1/en/plus/2357-national-housing-day-look-homeowners-and-renters

[3] https://economics.td.com/esg-housing-wealth-inequality

[4] https://thoughtleadership.rbc.com/proof-point-canadian-renters-face-higher-hurdles-to-accumulating-wealth-than-homeowners/

[5] https://www150.statcan.gc.ca/n1/daily-quotidien/220921/dq220921b-eng.htm

[6] https://www12.statcan.gc.ca/census-recensement/2021/as-sa/98-200-X/2021016/98-200-X2021016-eng.cfm

[7] CMHC Research Insight, November 2021

[8] https://www.globenewswire.com/en/news-release/2022/09/13/2514754/0/en/Equifax-Canada-and-FrontLobby-Complete-First-Rental-Tradeline-Study.html

[9] https://newsroom.transunion.ca/more-than-9-million-canadians-are-either-credit-unserved-or-underserved---approximately-14-migrate-to-being-credit-active-every-two-years/

[10] https://borrowell.com/blog/credit-score-mortgage-canada

[11] https://borrowell.com/blog/highest-canadian-credit-score-study

[12] https://themreport.com/news/data/11-14-2023/renters-agree-credit

[13] Reducing the Black-White Homeownership Gap through Underwriting Innovations-The Potential Impact of Alternative Data in Mortgage Underwriting

[2] https://www.statcan.gc.ca/o1/en/plus/2357-national-housing-day-look-homeowners-and-renters

[3] https://economics.td.com/esg-housing-wealth-inequality

[4] https://thoughtleadership.rbc.com/proof-point-canadian-renters-face-higher-hurdles-to-accumulating-wealth-than-homeowners/

[5] https://www150.statcan.gc.ca/n1/daily-quotidien/220921/dq220921b-eng.htm

[6] https://www12.statcan.gc.ca/census-recensement/2021/as-sa/98-200-X/2021016/98-200-X2021016-eng.cfm

[7] CMHC Research Insight, November 2021

[8] https://www.globenewswire.com/en/news-release/2022/09/13/2514754/0/en/Equifax-Canada-and-FrontLobby-Complete-First-Rental-Tradeline-Study.html

[9] https://newsroom.transunion.ca/more-than-9-million-canadians-are-either-credit-unserved-or-underserved---approximately-14-migrate-to-being-credit-active-every-two-years/

[10] https://borrowell.com/blog/credit-score-mortgage-canada

[11] https://borrowell.com/blog/highest-canadian-credit-score-study

[12] https://themreport.com/news/data/11-14-2023/renters-agree-credit

[13] Reducing the Black-White Homeownership Gap through Underwriting Innovations-The Potential Impact of Alternative Data in Mortgage Underwriting

Allwyn Dsouza is REIC’s Senior Analyst, Market Research and Insights. He can be reached at [email protected]. Media enquiries can be directed to [email protected]